As a company proprietor, it's finally your choice to remain along with your company receipts. Here are several tips that can assist you keep track of your paper and electronic receipts so that you can improve your company.

Paul Stephens, director of plan and advocacy on the nonprofit Privateness Legal rights Clearinghouse, needs you to prevent and Feel before you decide to voluntarily surrender another piece of personal information.

Either the email or PDF is saved to Dropbox. A url for each is copied and pasted into the right Google doc.

'I am able to see just about every services call for property repairs by taking a look at one particular grasp document. If I need the receipt, It really is a person simply click absent,” says Berger, who adds you could even give your grasp doc with embedded back links to receipts and statements on your accountant appear tax period.

Expense Reimbursement: Some corporations, especially company and authorities sectors, need Bodily receipts for expense reimbursement. These receipts serve as evidence of expenditure and help verify the legitimacy of promises.

Whenever possible, stay clear of spending in cash. Cash purchases still deliver receipts, of course. However they're tougher to trace. Unlike credit score or debit card buys, you will not be able to match your receipt to an exterior money document like a financial institution or charge card statement. Staying away from cash buys will help you preserve precision throughout your economic facts.

Concurrently, nevertheless, a swap to electronic-only receipts in all probability can be One more nail while in the coffin of one's privateness.

Whether you like paper or digital, you require an organizational method that actually works, specifically read more for receipts. Or else, you threat turning your disorganized receipt-stuffed cardboard shoe box into a digital just one. Here's a check out both of those choices.

California lawmakers evidently don’t Feel so. In 2019, they rejected a bill — AB 161 — that will have demanded stores to ask clients if they want a paper receipt prior to printing 1 out.

If a Rent Receipt is required, There exists a individual doc obtainable for a landord to deliver a receipt to get a payment of rent monies.

Thermal receipts are challenging to recycle. It is because they may have BPA or equivalent substances on them. These chemical substances may make the recycling procedure soiled.

When you finally scan your receipts, do you still must keep paper copies? That relies on your preferences. The IRS will enable you to post electronic receipts with all your tax return.

Monthly bill Invest & Price is definitely an impressive, intuitive expense management procedure. It'll let you both extract info from your business receipts and make expenditure reports routinely.

Even though Castaneda prefers electronic data, he does print and keep tax return documents in a large envelope marked 'Tax Return” as well as 12 months. 'Several organizations deliver digital copies of tax files for instance W-2s, brokerage and house loan statements, and property taxes, which I also print and retail store in my tax return file,” he states.

Edward Furlong Then & Now!

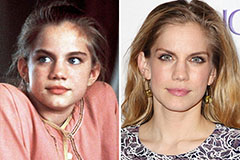

Edward Furlong Then & Now! Anna Chlumsky Then & Now!

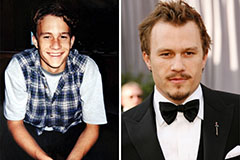

Anna Chlumsky Then & Now! Heath Ledger Then & Now!

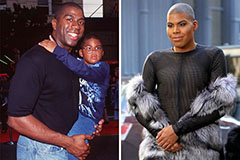

Heath Ledger Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!